All Categories

Featured

Table of Contents

The rest of their commercial genuine estate offers are for certified investors just. VNQ by Lead is one of the largest and well understood REITs.

Their number one holding is the Lead Real Estate II Index Fund, which is itself a common fund that holds a selection of REITs. There are various other REITs like O and OHI which I am a long-time investor of.

To be an certified financier, you have to have $200,000 in yearly revenue ($300,000 for joint investors) for the last 2 years with the assumption that you'll earn the same or a lot more this year. You can also be considered a recognized financier if you have a total assets over $1,000,000, individually or collectively, excluding their primary home.

What is Exclusive Real Estate Crowdfunding Platforms For Accredited Investors?

These bargains are often called private placements and they don't need to register with the SEC, so they don't provide as much info as you 'd expect from, say, a publicly traded firm. The recognized investor requirement assumes that someone who is approved can do the due diligence on their own.

You simply self-accredit based on your word. The SEC has additionally increased the definition of certified financier, making it less complicated for even more individuals to certify. I'm bullish on the heartland of America provide after that lower valuations and much higher cap prices. I believe there will certainly be continued migration far from high expense of living cities to the heartland cities due to cost and technology.

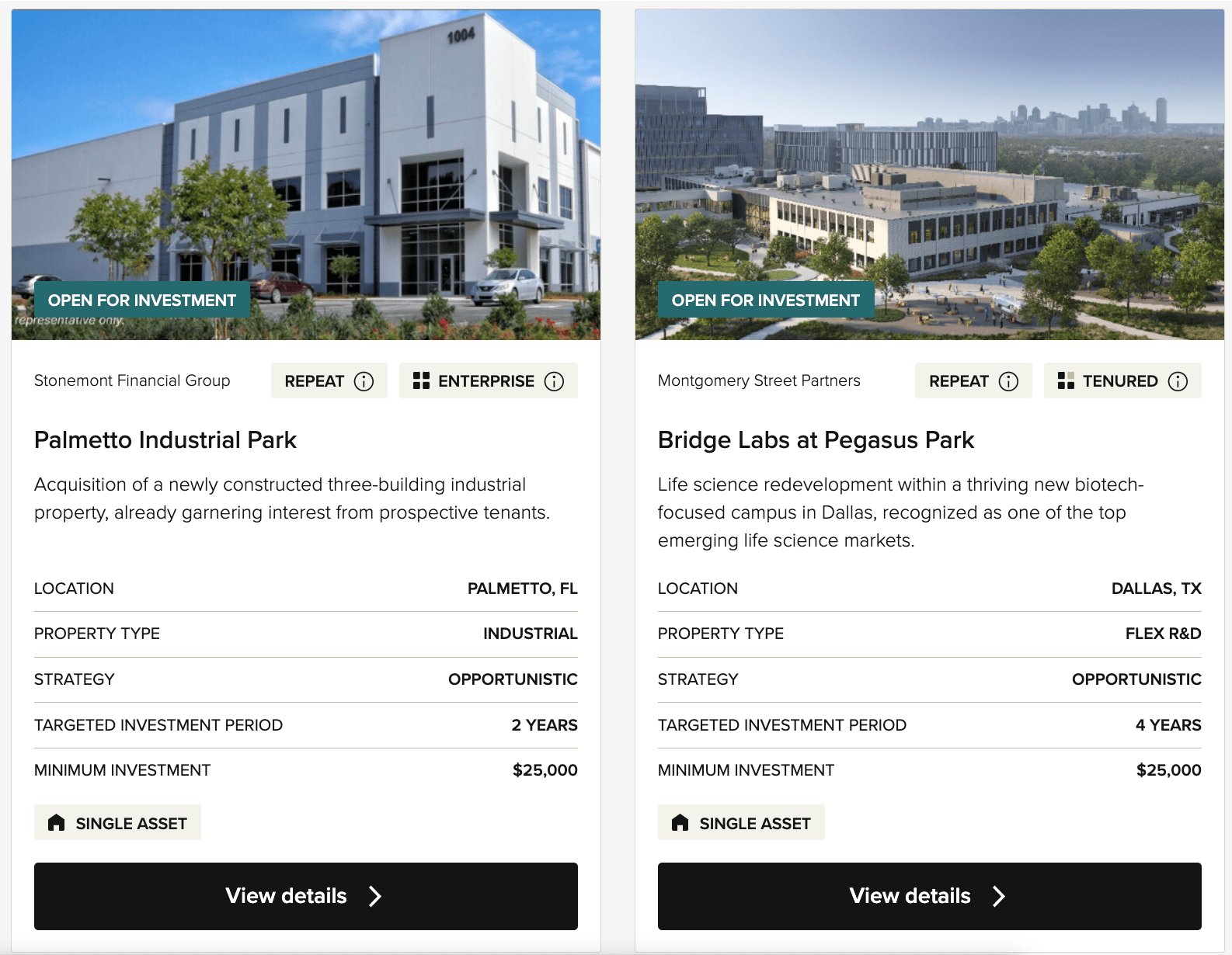

It's all concerning adhering to the cash. In addition to Fundrise, also examine out CrowdStreet if you are a certified investor. CrowdStreet is my preferred system for recognized capitalists because they concentrate on arising 18-hour cities with lower assessments and faster population development. Both are free to register and explore.

Below is my actual estate crowdfunding control panel. Sam worked in spending financial for 13 years.

He invests time playing tennis and taking treatment of his family. Financial Samurai was started in 2009 and is just one of one of the most trusted personal financing sites online with over 1.5 million pageviews a month.

Key Takeaways What are thought about the very best actual estate investments? With the united state actual estate market on the surge, capitalists are looking through every readily available building type to find which will help them earnings. So which industries and residential or commercial properties are the very best actions for investors today? Maintain reading to get more information about the best kind of realty financial investment for you.

Accredited Investor Real Estate Income Opportunities

Each of these kinds will come with distinct benefits and downsides that capitalists ought to assess. Let's look at each of the options readily available: Residential Realty Commercial Real Estate Raw Land & New Building Property Investment Company (REITs) Crowdfunding Systems Register to go to a FREE on-line realty course and learn just how to begin buying genuine estate.

Various other property properties consist of duplexes, multifamily residential properties, and vacation homes. Residential property is ideal for many financiers because it can be less complicated to transform earnings regularly. Of training course, there are lots of property property investing methods to deploy and various levels of competition throughout markets what may be ideal for one financier might not be best for the following.

Exclusive Real Estate Crowdfunding Platforms For Accredited Investors

The most effective industrial residential or commercial properties to purchase include commercial, office, retail, hospitality, and multifamily jobs. For financiers with a solid emphasis on enhancing their neighborhood areas, commercial realty investing can sustain that emphasis (Real Estate for Accredited Investors). One factor industrial buildings are thought about one of the very best kinds of property financial investments is the potential for greater money circulation

For more information concerning beginning in , be certain to review this article. Raw land investing and brand-new building and construction represent two sorts of genuine estate investments that can branch out an investor's profile. Raw land describes any kind of uninhabited land available for purchase and is most eye-catching in markets with high predicted development.

Buying new construction is additionally popular in quickly growing markets. While numerous capitalists may be unknown with raw land and new building investing, these investment types can stand for attractive revenues for capitalists. Whether you are interested in establishing a home throughout or profiting from a long-term buy and hold, raw land and new building and construction supply a distinct opportunity to investor.

What is the best way to compare Real Estate Investment Funds For Accredited Investors options?

This will guarantee you pick a preferable location and avoid the financial investment from being obstructed by market factors. Realty investment company or REITs are business that possess different business actual estate kinds, such as resorts, shops, workplaces, shopping malls, or dining establishments. You can purchase shares of these property firms on the stock market.

It is a requirement for REITs to return 90% of their taxable income to shareholders yearly. This uses financiers to receive returns while expanding their profile at the very same time. Publicly traded REITs likewise offer adaptable liquidity in comparison to various other types of property investments. You can market your shares of the firm on the stock exchange when you require emergency funds.

While this supplies the convenience of finding assets to financiers, this sort of genuine estate financial investment likewise presents a high amount of threat. Crowdfunding systems are commonly limited to accredited capitalists or those with a high total assets. Some websites offer accessibility to non-accredited financiers too. The main kinds of realty investments from crowdfunding platforms are non-traded REITs or REITs that are not on the stock market.

Why should I consider investing in Private Real Estate Investments For Accredited Investors?

The finest kind of actual estate investment will depend on your private situations, goals, market area, and recommended investing approach - Commercial Real Estate for Accredited Investors.

Selecting the best residential property type boils down to weighing each option's benefits and drawbacks, though there are a few crucial aspects financiers should remember as they seek the most effective option. When picking the very best sort of financial investment building, the significance of area can not be underrated. Investors running in "promising" markets might discover success with vacant land or new building and construction, while investors operating in more "fully grown" markets might have an interest in houses.

Evaluate your favored degree of involvement, risk tolerance, and productivity as you choose which building kind to spend in. Financiers wanting to take on a much more easy role may choose buy and hold industrial or properties and employ a home manager. Those wanting to handle an extra energetic function, on the other hand, may locate creating vacant land or rehabbing domestic homes to be much more fulfilling.

Table of Contents

Latest Posts

Buying Back Tax Properties

Back Taxes Property

Surplus Payments

More

Latest Posts

Buying Back Tax Properties

Back Taxes Property

Surplus Payments